What’s the message?

Grand Master Flash wrote a song in 1982 called "The Message". In it, he portrayed a person, like financial markets today, who was "trying not to lose his head" in the face of the malaise caused by double-digit inflation. A concern raised by the Bank of England in the face of inflation figures not seen since... 1982. We are therefore in a competition between narratives, signals and messages coming from macroeconomics, central banks, companies and governments in which it can become difficult not to get lost. Below we attempt to clarify these different messages for investors.

1- The message from the macro: back to 1982?

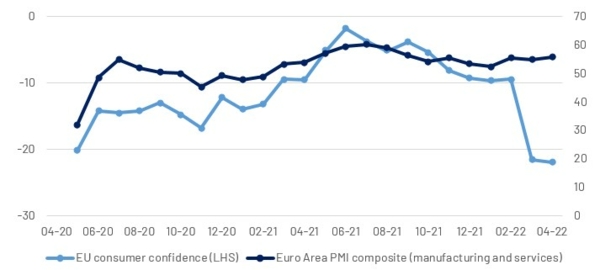

First message: economic growth is slowing. It may rebound slightly in the second quarter, but should continue to slow in the second half of the year and into 2023. This is what consumer confidence surveys and interest rate futures are telling us, in slight divergence with Purchasing Manager Indices (PMI, see Chart 1). The latter are effectively expressing the macroeconomic situation from the point of view of companies and are thus less affected by the direct impact of weaker purchasing power than consumers as illustrated by household surveys. Furthermore, PMIs are also biased by construction as longer supplier delivery times are contributing positively to the headline figure. Generally this is indeed seen as a positive signal of strong demand, but in the current environment it reflects the continued supply-chain disruptions.

Why do we have such a divergence? Probably because most of the cost of the current situation is incurred by households through the negative impact of inflation on real disposable income. As the earnings season reveals (see point #3), company earnings are thus far more resilient than expected, and negative real interest rates mean that financial conditions remain favourable despite credit spreads widening (see point #4).

Households in Europe and in emerging markets seem to be the most affected. In the Euro Area, wages are still growing below 3% with an inflation rate now reaching 7.5%. In the UK wages are growing faster (at 5%), but inflation is expected to reach 10% this year. The nature of the shock (higher food and energy cost) is asymmetric and affects primarily low income earners and governments are not all on the same page in terms of actions to curb inflation effects (see point #5). In the UK notably, regulated prices (energy price caps) have been adjusted by +54% in April. Therefore, we can anticipate an impact in consumption, notably in countries where governments (which earn significant taxes on energy) are not implementing price shields.

Chart 1: Euro area confidence indicators disintegrate

Source: Refinitiv, Indosuez Wealth Management

Second message: inflation has reached levels unseen since 1982 and could stay elevated for a longer period of time. The previous months have proven that inflation is a dynamic and non-linear adjustment process, whereby companies adjust their prices and households react to energy and food prices by asking pay rises. Therefore, it would almost be too easy ex post to highlight that central banks mistook inflation as temporary, linked purely to a rise in energy prices and supply-chain issues that were expected to dissipate rapidly. In reality, inflation has spread to many of its subcomponents, through: the prolonged impact of COVID-19 on services, extended supply-chain issues from China’s renewed lockdowns and the exponential impact of the Ukraine conflict on commodity prices. Finally, in the last few months the risk of a wage price loop in the US - that had previously been dismissed - has remerged. Going forward, we could well start to see inflation peak or plateau. For the moment, US inflation slowed for the first time since July 2021 (to 8.3% from 8.5% in March) although tensions remain in a number of sub-components. What remains disturbing is the continued rise in month on month core inflation (excluding energy and food), which increased by 0.6% in April. Nevertheless, US 2-Year inflation breakevens went down from 4.9% to 3.8% reflecting both the impact on prices of the expected economic slowdown and the impact of central bank actions (point #2).

Third message: job markets have been very resilient, but could start to tilt or turnaround soon, with the US unemployment rate that has begun to stabilise at 3.6%, and with job openings which should logically start to diminish a bit in the coming months. Acknowledging the lag effect between Europe and the US, we could well have wage growth starting to peak in the US and slow down to 4% (at 5.5% year-on-year in April) while European wages continue to accelerate. This lag could also be seen on central bank actions.

2- The message from central bankers: inflation is #1

Fighting inflation is the absolute priority. This view is now consensual between the Fed, the Bank of England (BoE) and many European Central Bank (ECB) Board members. The nuances lie mostly in the expected inflation paths and the course of actions that central bankers envisage as the most appropriate.

What does seem more and more consensual is the idea that central banks should raise interest rates sooner rather than later as the window to normalise rates is relatively short. This message is shared by prominent central bank members of the ECB (O. Rehn, F. Villeroy de Galhau), the BoE and the Fed.

Indeed, if inflation continues to rise and if growth were to continue to slow thereafter, central banks should increase rates now, and try to increase real interest rates (to cool down corporate investments, mortgage loans and consumer credit and incentivise savings).

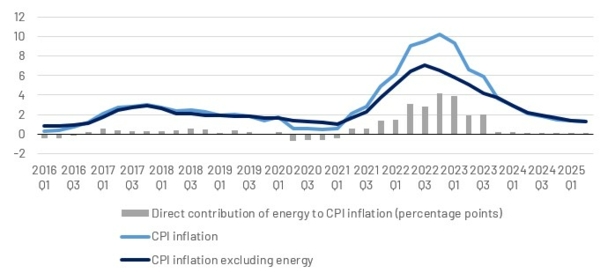

One challenge though is to be able to cool down inflation without putting the economy in recession and recreating too much unemployment. Probably that the risk would now be that some central banks will expect more inflation than what will happen in reality, after having been in “inflation denial” throughout 2021. Getting it right on core inflation figures for 2022 and 2023 is key, and assumptions are quite divergent with on the one side the Fed (anticipating core inflation at 4.1% in 2022 in 2.6%in 2023) and the ECB (also expecting moderate inflation in 2023), and on the other the Bank of England (anticipating total inflation to reach 10% in the coming month, and only going down towards 6.6% in Q2 2023 and core inflation to 5.1%, see Chart 2).

Chart 2: Bank of England inflation forecasts (%)

Source: BoE economic outlook, Indosuez Wealth Management

Likewise, there are also big differences between the Fed and the ECB with regards to debt sustainability and financial fragmentation issues. In the US, the Fed is focused on growth, employment and inflation as key objectives, while ensuring proper liquidity and financial conditions. The temptation for political influence on the Fed has always existed, and the borders between fiscal and monetary policies have eroded over time with quantitative easing policies, but the Fed seems to have managed relatively well at keeping its distance. In the Euro Area, the ECB is a pillar of the credibility for the currency and the zone’s stability, and fighting fragmentation risks remains a key objective for the ECB de facto. Investors wonder if and when the spread widening (notably on Italy, which spread to Germany doubled since December) will become uncomfortable for the ECB. At this stage, the ECB still needs to make the decision to put interest rates back in positive territory, while ending asset purchases in Q3 2022. This gradual monetary tightening context leads investors to question whether the reinvestment of PEPP maturing bonds will be sufficient to control spreads. Obviously it was not enough in the past months. From a fundamental standpoint debt sustainability is not an issue in 2022 as nominal GDP growth will probably exceed 8% this year, way above nominal interest rates. However, this question will resurface in 2023 or 2024, if nominal growth falls below 4% in some Euro Area countries. Nevertheless, we believe the ECB will not be able to go too far in its monetary tightening and will remain in a "fiscal dominance" regime (monetary policy dictated by budgetary constraints).

In this predominantly hawkish world, a noticeable difference exists in Asia, where two major central banks are embarking on a different journey. The Bank of Japan (BoJ) will continue to control its yield curve in the absence of inflationary pressure, while the People’s Bank of China (PBoC) has to stimulate more in a context where growth dynamics have been crippled by renewed lockdowns and to a lesser extent positive real rates.

3- The message from corporates is constructive

The Q1 earnings season that has just taken place has beaten analyst expectations more significantly than what we expected in this complex macro and geopolitical equation. Management guidance, however, remains relatively cautious on the outlook.

Overall, profit margins were more resilient than feared in the US (notably in sectors such as utilities and staples) while profit growth surprised positively by 4 points in the US and 13 points in Europe (7 points if we exclude energy). In contrast, cyclical sectors such as banks and consumer discretionary disappointed slightly either on revenues or on costs.

The bottom up picture is, therefore, relatively more constructive than what macro data suggests and what central banks are saying, but it is confirming the view that inflation is spreading. If corporate margins are resilient, this may mean that they are merely passing cost increases through to consumers, all other things being equal (notably productivity gains). Looking ahead, margins should however remain under pressure and sales volumes will be constrained by purchasing power. The expected recovery of US net income margins to above 13% in Q3 (as estimated by FactSet consensus), seems difficult to achieve especially for the most cyclical sectors such as consumer discretionary. In Europe more specifically, we also should monitor the wage negotiation cycle (which is lagged compared to what we have observed until now across the Atlantic) with wage increases only starting to build up and that could weigh on margins in areas such as services.

Regarding corporate balance sheets, they remain relatively solid: current default rates are low (below 2% in Europe and the US) and should remain so. On the other hand, we need to take into account the tightening of financial conditions and a scenario of stagnation that could lead to a rise in default rates from 4% to 5%; a higher level, but still far from the ones observed during recessions.

4- The message from markets is bearish

Despite this relatively strong earnings season, equity markets have entered in correction mode, with bear market signals flashing on indices such as the NASDAQ (where the correction had already started in November 2021) while the volatility on equity markets, as measured by the VIX index, is now hovering over 30. The technical rebound that occurred after the peak of stress in Ukraine in early March has proven to be short lived: why?

The correction was largely driven by a repricing of markets in correlation with higher bond yields. Since early its March lows, the US 10Y yield has increased from 1.7% to 3% on a nominal basis. And on a real basis - if we use inflation breakevens as a reference for future inflation – 2-Year and 5-Year real yields have increased in the past 3 weeks due to the fall in inflation breakevens that started to go down after Q1 US GDP was released. This has led to a generalised reset of valuations after a strong expansion last year, especially in technological stocks, which has had an impact on the entire US equity market due to the weight of Growth stocks in indices such as the S&P 500; while recession fears also weighed more globally on risky assets.

Sectors which were the most affected by this phenomenon were expensive Growth stocks (notably technology and the luxury good sector), which are long duration assets, while Cyclical names that disappointed on their earnings underperformed as well.

This leaves investors with no other option than to increase Quality and Defensive stocks, which tend to outperform during such macroeconomic periods, and to focus on sustainable returns if they do not want to bet on the direction of indices.

This trend could of course reverse momentarily if long term rates were to reverse, but we think that the valuation spread between Growth and Value stocks is still elevated on historical standards and remains vulnerable to a continued increase in long-term rates.

5- The message from politics and society

The current inflationary regime and subsequent loss of purchase power is putting strong pressure on western governments; it has contributed to the erosion of popularity for President Joe Biden and to a greater political polarisation in France during the last elections. Governments are logically worried about rising social tensions which could lead to disruptions as France experienced it during the yellow vests movement in Q4 2018.

The general message from politics is the recognition of the need to increase wages and curb inflationary pressure; the latter is a change in the nature of the message passed by governments to central banks. Until recently, under the « fiscal dominance » model, governments were urging central banks to maintain ultra-accommodative monetary policies to sustain growth and ensure debt sustainability through low refinancing costs.

The nature of the pressure of governments on central banks seems to be evolving today. Indeed, high nominal GDP growth levels this year may have put the question of debt sustainability on hold, but public anger over inflation has put pressure on governments to act in many different directions at the same time: providing energy price shields, increasing minimum wages and pensions, while urging central banks to fight inflation, thereby hitting the brake and the gas pedal at the same time.

The risk is of course that social tensions push governments to restore a form of re-indexation of wages and pensions on price increases, which was one of the central causes of 1970s inflation. But implicitly, even if they need to show that they are fighting inflation, governments have an implicit preference for inflation which optically helps to control the debt / GDP ratios, even if the past tells us that there is no such thing as a free lunch on this (in the 70s & 80s, this was weakening the franc against the Deutsche Mark).

This leads us to think that fiscal policies will remain accommodative despite the slight normalisation underway, and that public debt ratios which are artificially subsidised by inflation (as per above) could resurface as a source of concern when nominal GDP growth will come down in 2023-2025.

Conclusion

We believe that the most recent macroeconomic data continues to feed the stagflation narrative; while inflation continues to spread to a wider number of components. Inflation is not cooling down, and the idea that core inflation could go down towards 2.5% next year has been challenged by the Bank of England. This is putting pressure on central banks to act faster and stronger. In this context, investors should continue to focus on assets capable of delivering returns above medium term expectations.

Stocks of companies generating high free-cash flow (in listed or private markets) and short dated USD corporate debt are examples of such assets, notably on sectors that benefit from the current regime shift and / or have low leverage. These are the sectors that delivered a good earnings season in Q1. This explains why we maintain our preference on Value and Quality stocks in this context, at the expense of Growth stocks on which investors may want to wait further before buying the repricing of the past few months.

May 13, 2022